CONTRIBUTIONS

If you opted into the BRS during calendar year 2018, you can immediately elect to contribute any whole percentage of your pay, up to the annual limits set by the Internal Revenue Service (IRS). You will receive the Service Automatic (1%) Contribution, and Service Matching Contribution proportionate to your basic pay contributions, on the first pay period after opting in.

MATCHING CONTRIBUTIONS

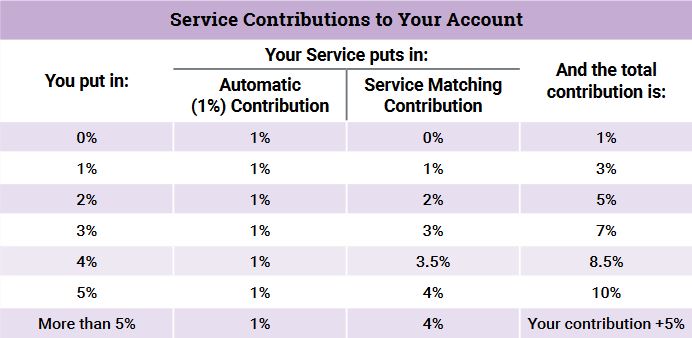

Under the BRS, you may receive up to 4 percent in Service Matching Contributions, on top of the Service Automatic (1%) Contribution based on the below chart. Automatic and matching contributions continue through the end of the pay period during which you reach 26 years of service.

VESTING

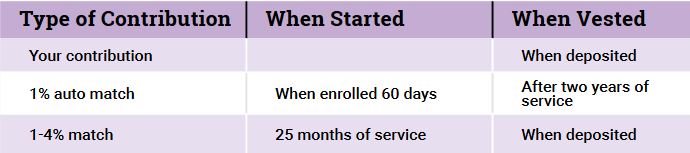

Being vested means having ownership. You are always vested in (entitled to) your own contributions and their earnings. If you opted into the BRS, you’re also immediately vested in the Service Matching Contributions and their earnings. To become vested in the Service Automatic (1%) Contribution, you must have completed two years of service. All Service members who have completed two years of service are considered fully vested.

JOIN THE UNIFORMED SERVICES ON OR AFTER JAN. 1, 2018?

If you join the Uniformed Services on or after Jan. 1, 2018, you are automatically covered by BRS and subsequently enrolled into the TSP in an age-appropriate Lifecycle (L) fund with a default contribution of 3 percent of your basic pay. While you can opt out of this automatic enrollment, by law you will be automatically re-enrolled each calendar year. You can adjust your contributions anytime, as long as you stay within the annual limits set by the IRS. Service Automatic (1%) Contributions to TSP accounts start after 60 days. Your ability to earn Service Matching Contributions, up to an additional 4 percent, starts at the beginning of your 25th month of service.

PORTABILITY

Your TSP account is a portable retirement benefit. This means that when you leave service, you can have TSP transfer part or all of your account into an IRA or an eligible employer plan (for example, the 401(k) account of a new employer).

SERVICE CONTRIBUTIONS TO YOUR ACCOUNT GRAPHIC GOES HERE